The world faces significant water challenges today, with more than 2 billion people lacking access to safely managed water, and more than 4 billion people without safely managed sanitation. While some believe these challenges are concentrated in the developing world, water scarcity is not linked to a particular location or circumstance. It is a global problem with underlying trends moving in a distressing direction.

Demand for water continues to outpace supply, while supply disruptions occur more frequently, often due to extreme weather events driven by climate change. Furthermore, the infrastructure needed to meet the growing demand for water is either old and deteriorating or simply lacking altogether. The situation is dire enough that NASA researchers have claimed that water shortages will be “the key environmental challenge of this century.” 1

Larger urban populations and a more industrialized world

Increasing economic development, in combination with population growth, is a key contributor to the water supply-demand imbalance. In emerging economies, higher disposable incomes often result in lifestyle changes that increase water demand. For example, as the middle class grows, demand rises to support a more water-intensive diet or overall lifestyle. With food demand expected to increase 50% over the next 30 years, pressure on water supply will intensify. Additionally, many growing populations are gravitating toward cities already dealing with water scarcity or inadequate infrastructure. By 2030, there is expected to be a 40% shortfall of renewable water supply to meet growing demand.

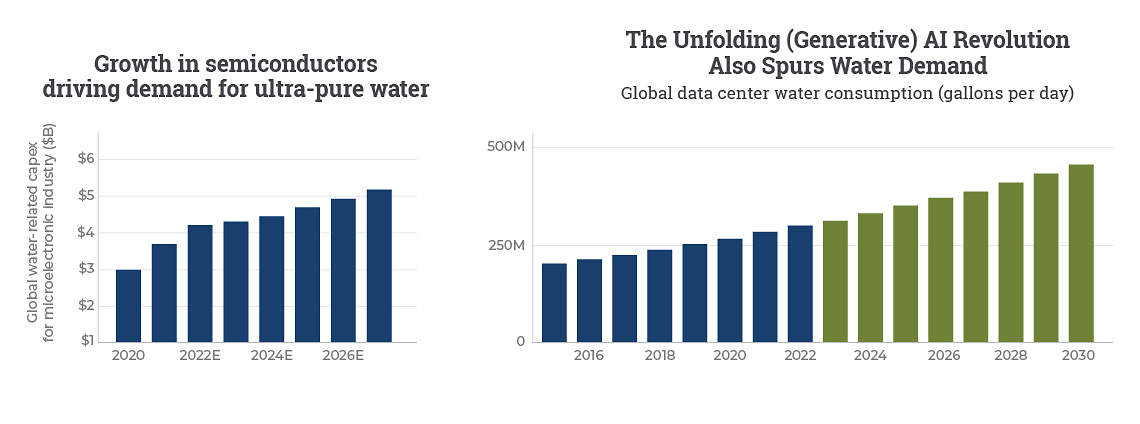

Changing business needs also contribute to increasing demand for water. Pharmaceuticals and semiconductor manufacturing are notably water-intensive, while the proliferation of data centers and the electrification of transport will inevitably result in more water needed for power generation. As a result, corporate end-users of water are increasingly aware of their underlying water footprints (water usage in operations) and are implementing initiatives to improve water sustainability to offset growing demand.

Supply disruptions and the threat of contamination

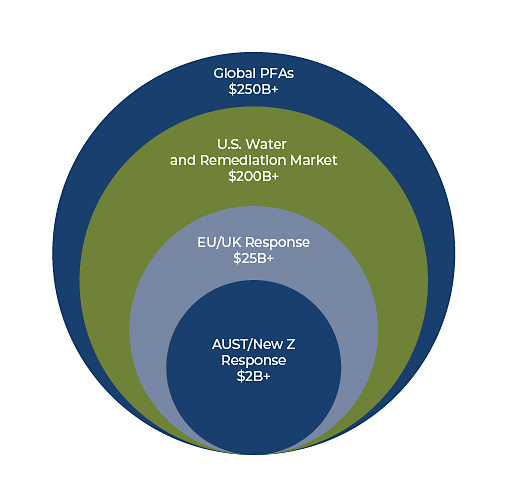

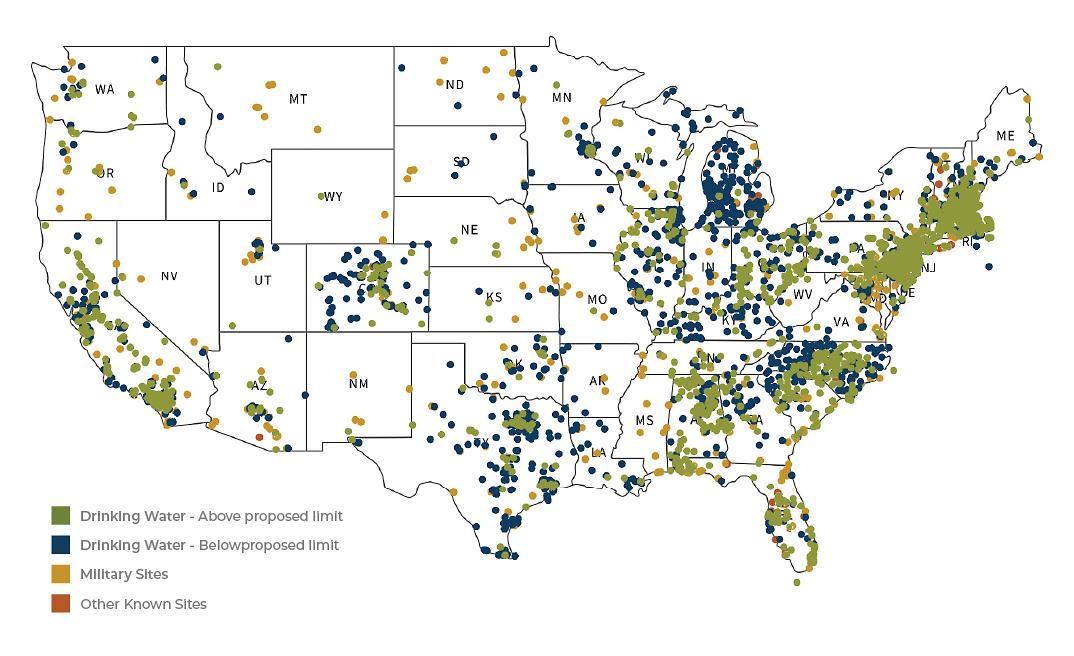

The increase in demand is not the only driver of water scarcity, as challenges with water supply and infrastructure also play a role. Currently, due to poor infrastructure, water loss rates are estimated to be 30% globally. These challenges are exacerbated by climate change, which is creating more severe weather patterns including prolonged droughts, flooding, and unseasonal temperatures. As a result, places that once had adequate water might now require significant infrastructure upgrades to weather storms and meet residential and industrial needs. Meanwhile, questions continue to arise regarding the safety of freshwater supplies due to emerging contaminants, specifically PFAs. PFAs which are commonly known as “forever chemicals”, break down slowly and have been linked to a variety of human health problems, including cancer. The U.S. Environmental Protection Agency recently proposed the first federal limits on PFAs, which will have significant implications for testing and treatment of water supplies around the country. We expect these rules to be finalized in the first half of 2024.

While the widening supply-demand imbalance has given rise to an imposing set of problems, the good news is that we can fix them if we apportion enough public and private capital to build out and improve water infrastructure globally. Additionally, investment in water-related technologies will be critical in combating water scarcity and quality issues leading to a more sustainable water future. As such, investors can help meet this need for capital by investing in the long-term structural growth of the water sector. Moreover, the environmental benefit to investing in water resource preservation is obvious, given its essential nature and the fact that no substitute exists.

What is the water investment opportunity?

Water is the most used, but also the most underinvested commodity. Trillions of dollars of investment will be needed to improve water sustainability. We see three areas where investors can become part of the solution and benefit from the sector’s secular tailwinds:

Opportunities in Water Investment

Water Supply | Water Quality | Water Efficiency

By targeting these three areas, investors can access a potential source of long-term growth at risk levels that have historically been lower than other types of growth stocks. Unlike many other growth areas such as technology innovators, companies in the water segment have tended to offer already well-established and cash-generating business models with strong client relationships that are not easily disrupted, given that the reliance on sufficient and safe drinking water creates high barriers to entry.

Each area offers unique investment opportunities.

Increasing Water Supply

These companies are defined as water network operators, water infrastructure players, or companies that produce supply-related components such as pipes, pumps, and valves. These companies are also increasingly developing and deploying technology to maximize water supply in the municipal and industrial end-markets. They distribute water to growing populations, improve storage capacity, or help to convert saltwater or wastewater into usable water. U.S. infrastructure alone is estimated to need $3 trillion in improvements—much of that water-related. Enter a pure play company that specializes in water infrastructure, including clean water distribution, wastewater collection, and treatment.

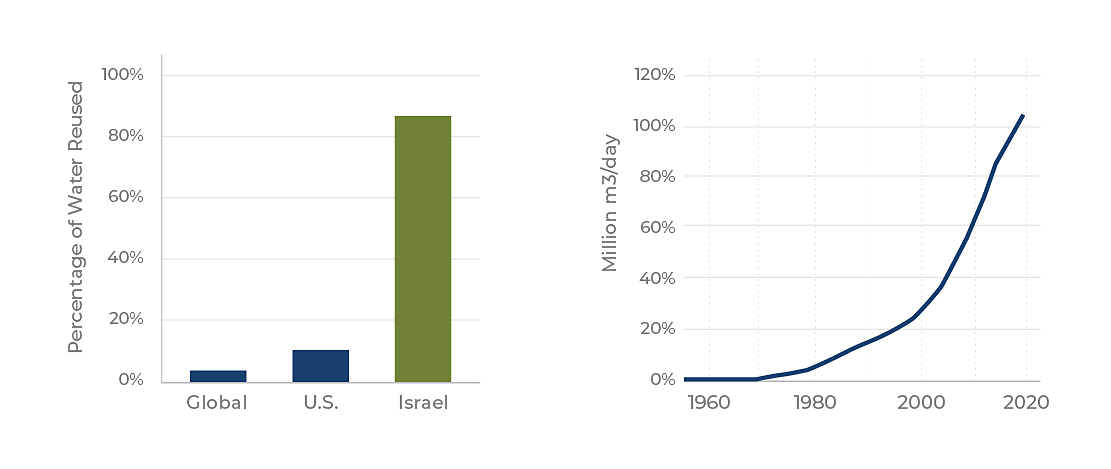

Israel, a Leader in Reuse, is an Example

for Increased Global Adoption While

Desalination Cost Declines

Driving Capacity Growth

Source: R. Liemberger, A. Wyatt; “Quantifying the global non-revenue water problem.” Water Supply, 1 May 2019; 19 (3): 831–837. doi: Yale Environment.

Enhancing Water Quality

These companies offer wastewater treatment services, monitoring and testing services technology as well as waste management equipment and services. They ensure that drinking water is safe for consumption, working at the forefront of testing and treating contaminants like PFAs. A company could also help manufacturers re-use significant amounts of wastewater in arid regions or produce ultra-pure water to support the development of semiconductors and healthcare.

Substantial Expected Global PFAs Spend

Source: Aecom PFAs presentation “What is the addressable PFAS market?” June 2023

Mapping the PFAs Contamination Crisis

Source: Environmental Working Group.

Improving Water Efficiency

These companies offer products that allow customers to reduce water consumption without a loss in productivity, i.e., by reducing wastage or fixing leaks. For example, in the agricultural sector, center pivot and drip irrigation can result in significant water improvements, with center pivot irrigation technology enhancing water efficiency by up to 95%. Additionally, businesses are increasingly aware of water challenges, with two-thirds facing substantial risk from water stress. As a result, industrial users of water are turning to water specialists to ensure uninterrupted quantity and quality of water, implement water reuse, and advance sustainability initiatives.

Source: Bluefield Research

Why Duff & Phelps

The Duff & Phelps Water Strategy invests in companies that actively address water scarcity and improve the sustainability of global water resources. Investments are focused on water infrastructure and equipment/technology companies that enhance water supply, quality, and efficiency. Building on the firm’s strong legacy of in-depth fundamental research, the Duff & Phelps Water Team aims to deliver a higher-quality and more concentrated pure-play water portfolio versus peers. In addition to offering investors access to attractive secular earnings growth and durable cash flows, the strategy is closely aligned to four of the 17 UN Sustainable Development Goals, with a focus on Goal 6, which calls for water and sanitation for all by 2030.

Recent events indicate that the world has begun to recognize the urgency of addressing water scarcity. Infrastructure has become a key item on political agendas around the world, and new spending has the potential to unleash a flood of projects aimed at upgrading water infrastructure from its current old economy bricks-and-mortar state to a more automated, smart, digital, 21st-century iteration. By stepping up now, investors can reap the potential financial rewards while also driving positive change in an area where it is needed most.

1Source: Harvey, Fiona. (2018, May 18). Water Shortages to be Key Environmental Challenge of the Century, NASA Warns. The Guardian.

This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities. Forward-looking statements are necessarily speculative in nature. It can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. An increase in interest rates can cause markets to decline and certain companies and sectors may be adversely impacted. Different periods in time and longer periods may produce results that vary. Indices are not available for direct investment and do not reflect the deduction of any fees. Duff & Phelps Investment Management Co. services are not available in all jurisdictions and this material does not constitute a solicitation or offer to any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Past performance is not indicative of future results.