The energy sources we use are evolving rapidly with the adoption of renewable energy policies globally across private and public entities, marking an alternative energy revolution. As the world transitions to lower-carbon energy sources, many opportunities to invest in energy technologies, generation, and transmission of renewable energy have emerged. Today’s opportunity set, representing the “clean energy” universe, has expanded to include solar, wind, water, geothermal, bioenergy, nuclear, hydrogen, and battery storage. At the same time, economy and efficiency of clean energy production has continued to increase, due in large part to advances in technology.

Long-term value is supported by strong demand from private and public consumers, revenue growth that is well above average, and global government-supported funding, including the United States’ Inflation Reduction Act and the European Commission’s Green Deal Industrial Plan. Over the medium- to long-term we see immense value in the clean energy sector investment opportunity set. Moreover, the sector’s recent underperformance has increased the value offered by clean energy companies, as the sector now trades near its lowest levels relative to broad stock market valuations.

Unprecedented demand driving value in Clean Energy

In 2022, renewable energy production and consumption both reached record highs, with energy from renewable sources supplying 13% of total U.S. energy demand and 23% of U.S. electricity demand. Increased clean energy production and consumption will be supported by expected flows of trillions of dollars annually into the sector via public and private investment. This year, the International Energy Agency (IEA) expects more than $1.7 trillion worldwide to be invested in clean energy technologies, including wind, solar power, electric vehicles, and batteries, compared to just over $1 trillion invested in fossil fuels. The IEA expects annual clean energy technology investment to grow to $4.5 trillion by 2030. The following are factors contributing to increased clean energy investment.

- Global fiscal spending bills focused on the development and building out of renewable energy sources are a strong tailwind. These bills include trillions of dollars earmarked for clean energy investment, which solidifies the ongoing energy revolution.

- Inflation Reduction Act – U.S. bill aimed at directing investment to clean energy projects over the next 10 years, with explicit goals of achieving targets with respect to the percentage of energy generated from alternative sources. It was signed into law in August 2022, with funding expected to begin being put to work in 2024.

- Europe has taken a similar route to the U.S. in the area of clean energy legislation, including the European Commission’s Green Deal Industrial Plan.

- The growing global need for energy independence has become a matter of national security for many nations, as highlighted by Europe’s recent struggles with energy sourcing in the face of tensions with Russia.

- Utility companies’ growth plans and capital spending projects are heavily weighted toward renewable sources.

- Infrastructure to transmit renewable energy needs to be built out, as we have seen substantial advances in technology and development.

What opportunities exist?

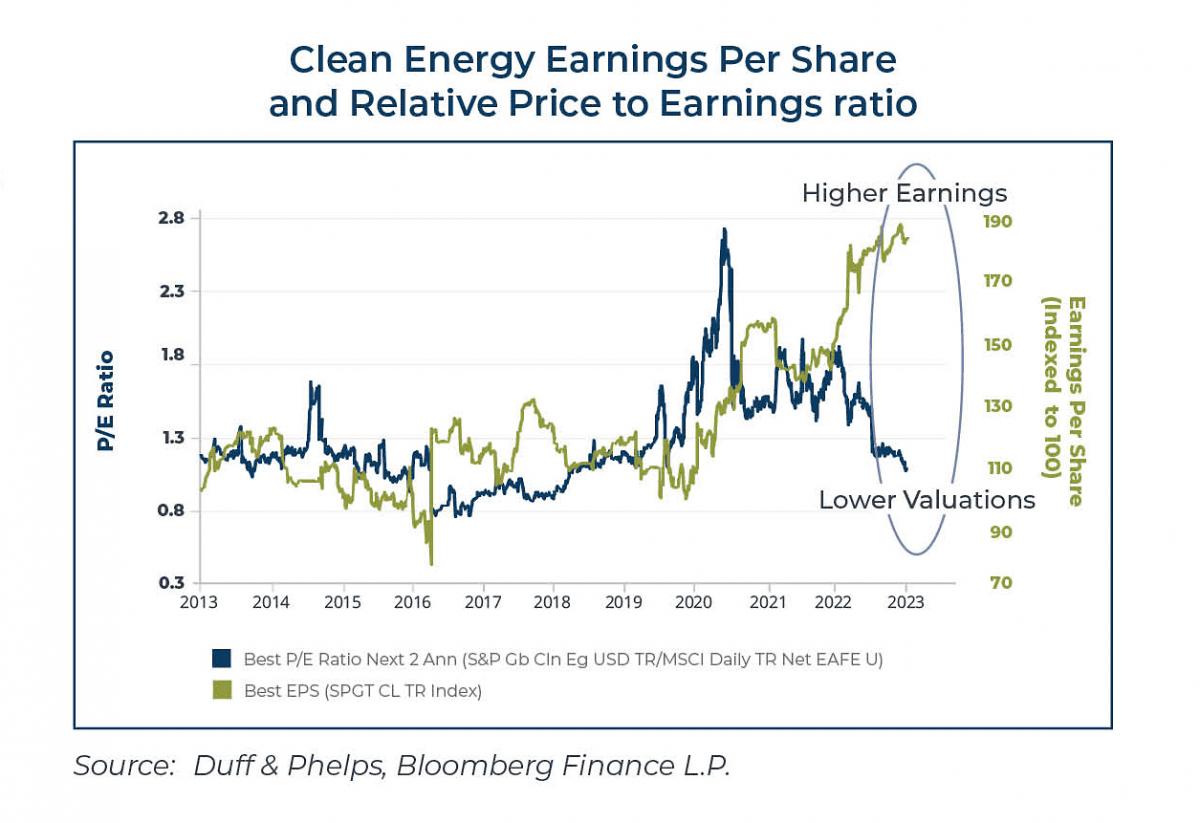

We see clean energy company stocks trading near historically low valuations vis-à-vis broader equity markets as a good buying opportunity. With increased demand for energy alternatives, profits have grown rapidly across the clean energy sector, outpacing the MSCI EAFE Index by a wide margin.

However, the clean energy sector has been a notable underperformer, as many investors weigh the impact of higher interest rates on clean energy companies, along with the notable rise in prices of cost inputs due to elevated inflation. A net result is that price-to-earnings ratios relative to the MSCI EAFE Index are near 10-year lows at 1.1x, while earnings per share is growing beyond the market and well above historical levels, as shown in the following graph. The blue line represents the price to earnings multiple of clean energy to the price-to-earnings ratio of MSCI EAFE, while the green line shows index earnings per share for clean energy.

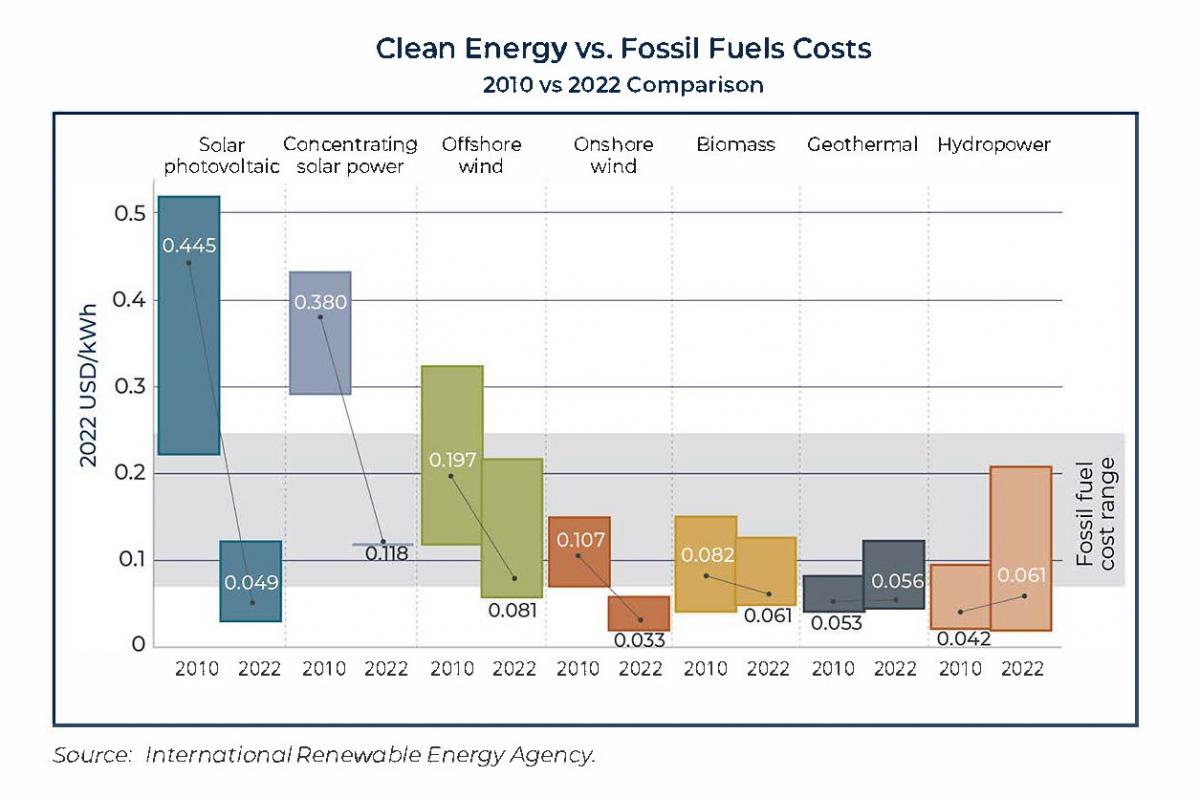

While input cost inflation has been a concern, wind and solar still provide notable cost advantages to consumers, as both are cheaper alternatives to traditional energy sources. In 2022, 86% of the new utility-scale renewable energy generation that was built globally cost less than the cheapest fossil fuel options.

To summarize, we see value in clean energy, though rising costs and growth pains in the industry are likely to create greater performance dispersion across companies. That is, there will be some major winners, while other clean energy companies will face definitive struggles. All of this points to a greater need today for active management with careful security selection.

What are the risks?

As we have noted, global support of the ongoing energy revolution to transition and expand energy sources is robust. Two primary risks to persistent growth are cost and political pressures. Solar and wind power development has recently experienced cost pressures, resulting in higher prices for end consumers on newer builds. On the political front, there is not yet a broad consensus with respect to ideological viewpoints on this subject, which brings about political risk for future funds expected to come from the recent Inflation Reduction Act and CHIPS (“Creating Helpful Incentives to Produce Semiconductors”) Act.

Given that we are nearing 2024, an election year, political risk carries increased importance, with the issue split between Democrats generally favoring energy transition and Republicans focused more on related costs to taxpayers and less on environmental concerns. Related to this is uncertainty around the details of where and how funding from the Inflation Reduction Act will be distributed, which may result in delays with respect to execution of the legislation’s clean energy-related provisions. At the same time, with the substantial boosts to clean energy firm earnings that it may provide, the Inflation Reduction Act continues to serve as a strong tailwind for the sector.

How best to invest?

With trillions of dollars in annual clean energy investment expected, there are several thematic clean energy opportunities on which to capitalize, including in technology, project development, and distribution. In addition to the well-known areas of wind and solar, there are also opportunities in hydrogen and renewable natural gas, among other subsectors.

We see particular value in the transmission of renewable energy to end consumers, in large part due to factors of scalability, scarcity, and demand. As an example, wind farms cannot provide electricity if they are not connected to end consumers, and therefore the installation of energy transmission cables to deliver energy to homes is necessary. There is a sizeable backlog of transmission projects awaiting commencement that presents a clear opportunity for evaluation and investment. Projects that enjoy geographically advantaged positions near end consumer markets are especially of interest.

We also see opportunities in clean energy technologies that contribute to the development and use of renewable energy resources. We seek companies with strong balance sheets, stable customer bases, and unique, proven technology. Sustained and increasing market demand is a compelling factor driving investment opportunity in the clean energy sector.

This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities. Forward-looking statements are necessarily speculative in nature. It can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. An increase in interest rates can cause markets to decline and certain companies and sectors may be adversely impacted. Different periods in time and longer periods may produce results that vary. Indices are not available for direct investment and do not reflect the deduction of any fees. Duff & Phelps Investment Management Co. services are not available in all jurisdictions and this material does not constitute a solicitation or offer to any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Past performance is not indicative of future results.